ESG Reporting

July 25, 2023

ESG reporting is gaining significant momentum. It’s all about disclosing information covering an organization’s operations and risks in three areas: environmental stewardship, social responsibility, and corporate governance.

Consumers look to ESG reports to find out if they are supporting a company whose values align with theirs. Meanwhile, investors look for qualitative and quantitative information to help them screen investment opportunities according to the ESG factors.

In the United States, companies of all sizes have been encouraged to produce ESG reports to guide their own decisions and to help investors get further company insights, leading to a more sustainable and socially responsible future.

To date, there is no stand-alone mandatory sustainability reporting in the United States. The U.S. Securities and Exchange Commission (SEC) only requires companies to report on information that may be material to investors, which includes ESG-related risks.

In this article, we will explore the ESG report in considerable detail, including a look at the best approach to ESG reporting, and all the elements contained within these complex reports.

We will then look at how ESG reporting differs from a PR campaign, and the push for business leaders to become financially accountable for the impact their business activities have on the environment and the wider community. Specifically, we will look at how businesses are absorbing these costs and the actions they are taking to mitigate their impact.

What is an ESG report?

An Environmental, Social, and Governance (ESG) report is a comprehensive document that provides stakeholders with detailed information about an organization’s environmental, social, and governance practices.

The report serves as a means for companies to communicate their commitments, strategies, and performance in these key areas, and it is often used by investors, customers, employees, and other stakeholders to assess a company's sustainability and responsible business practices.

An ESG report typically includes data and analysis related to the company's environmental impact, such as energy consumption, greenhouse gas emissions, waste management, and water usage.

It also covers social factors, such as labor practices, employee diversity and inclusion, community engagement, and supply chain management.

In addition, the report addresses governance aspects, including board composition, executive compensation, risk management, and ethical business practices.

ESG reports are usually prepared in accordance with recognized frameworks and standards, such as those developed by the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), or the Task Force on Climate-related Financial Disclosures (TCFD). These frameworks provide guidelines and indicators for companies to measure and disclose their ESG performance in a standardized and comparable manner.

The purpose of an ESG report is to enhance transparency, accountability, and trust between companies and their stakeholders.

It allows investors to make informed decisions based on a company’s sustainability practices and performance, as well as its ability to manage risks and seize opportunities related to ESG factors.

Lastly, ESG reports can help companies identify areas for improvement, set targets, and develop strategies to enhance their overall sustainability and long-term value creation.

ESG Report Breakdown

An ESG report typically encompasses a range of elements that collectively provide a comprehensive overview of an organization’s environmental, social, and governance practices. While specific content may vary based on company size, industry, and reporting frameworks, the following elements are commonly included:

- Introduction and Company Profile. This section provides an overview of the company, including its mission, values, and core business activities. It may also cover the company’s governance structure, ownership, and key stakeholders.

- Governance. This element focuses on the company’s corporate governance framework, including board composition, structure, and independence. It addresses topics such as executive compensation, risk management practices, board diversity, and the company’s approach to ethics and compliance.

- Environmental Performance. This section details the company’s environmental impact and efforts to mitigate it, including information on energy consumption, greenhouse gas emissions, water usage, waste management, pollution control, and conservation initiatives. It may also cover the company’s approach to sustainable sourcing and the circular economy.

- Social Performance. This element examines the company’s social impact and engagement with various stakeholders. It covers topics such as labor practices, employee health and safety, workforce diversity and inclusion, human rights, community engagement, philanthropy, product safety, and customer satisfaction. It may also include information on supply chain management and responsible sourcing.

- Stakeholder Engagement. This section highlights the company’s efforts to engage with and respond to the needs and concerns of its stakeholders. It may include details on stakeholder identification, dialogue mechanisms, materiality assessments, and the incorporation of stakeholder feedback into decision-making processes.

- Performance Indicators and Metrics. ESG reports often include a set of key performance indicators (KPIs) and metrics to quantify and track the company’s progress in environmental, social, and governance areas. These metrics can be both qualitative and quantitative, allowing for meaningful comparisons over time and with industry peers.

- Targets, Initiatives, and Progress. Companies typically outline their ESG goals, targets, and initiatives in this section. It provides information on specific programs or projects aimed at improving performance, reducing environmental impact, enhancing social contributions, and strengthening governance practices. Progress updates and milestones achieved may also be included.

- Reporting Frameworks and Standards. ESG reports often reference the frameworks and standards followed during the reporting process. This includes mentioning compliance with internationally recognized guidelines, or other industry-specific frameworks.

- External Assurance. Some companies choose to undergo external assurance or verification of their ESG data and reporting processes to enhance credibility. This section outlines the scope and outcomes of any external assurance procedures conducted on the ESG report.

- Future Outlook and Strategy. The ESG report may conclude with the company’s future outlook and strategic direction regarding sustainability and responsible business practices. It can include long-term goals, commitments, and the integration of ESG considerations into the company’s overall business strategy.

Why is it so important for businesses to publish ESG reports today? Senior writer and editor Barbara Adams at The Writers For Hire answers:

“Companies, especially those that are publicly held, are under tremendous pressure from environmentalists and Wall Street to prove that they are running their business in line with accountability standards for ESG factors.

To be honest, none of this is really new – for decades, companies have used their annual reports to show how they are good citizens when it comes to the environment, sustainability, social responsibility, or diversity. And, of course, good governance is part of running an ethical business and making money for shareholders – it’s part of the board’s fiduciary responsibilities.

To me, ESG reporting is another way of packaging that information, so readers get a really comprehensive view of a company’s goals and achievements in those areas. The ESG report shows how accountable and transparent a business is. McKinsey’s research shows how ESG reporting is linked to value creation and even cash flow.

The ESG report doesn’t replace the annual report for public companies; it adds to it. And it gives privately held companies a vehicle for talking about what’s important to them. It helps the market and investors find companies that align with their own values.

In the U.S., ESG reporting is not mandatory, although that may change – the SEC has hinted as much. In other parts of the world, there’s a requirement to report ESG activities. Whether it’s mandatory or not, there are reporting standards that companies who produce ESG reports have to meet.”

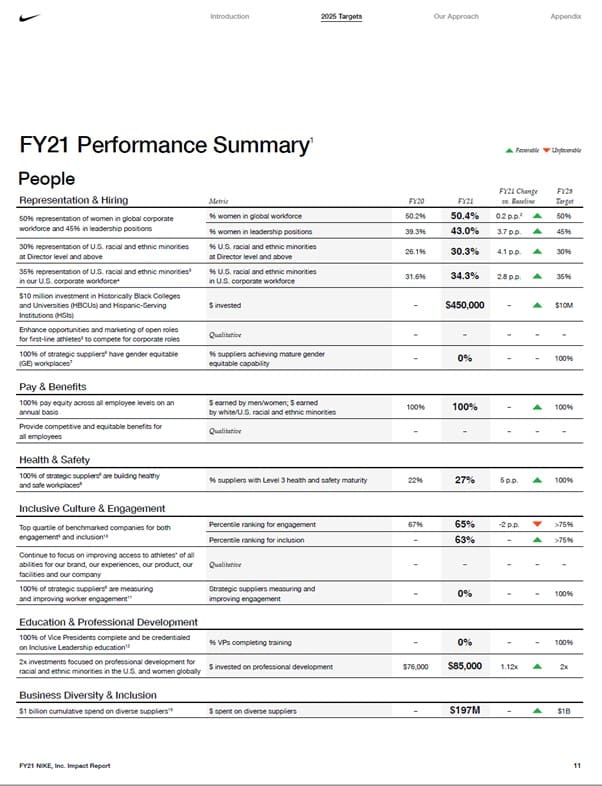

Although ESG reports will vary significantly between businesses and industries, they should at the very least broadly follow the above framework. An exceptional example of a well-developed ESG report is one published by Nike® on March 3, 2022, titled “FY21 NIKE, Inc. Impact Report.”

In their impact report, Nike covers a myriad of ESG related issues, including their carbon reduction efforts, waste, water, chemistry, pay and benefits, representation and hiring, health and safety, and education and professional development, to name a few. See an example of one of their performance summaries in their report below:

What role does an ESG report play in determining investment decisions?” Adams says:

“Grading investments against ESG criteria — ESG investing — is a huge trend, particularly among certain large institutional investors. While generally everyone wants a positive financial return on their investment, ESG investing is about backing companies that hold certain values. The ESG report is the best way for a company to disclose the non-financial matters that affect investment decisions.”

A Solid Approach to ESG Reporting

Developing an ESG report requires a systematic and strategic approach.

This approach ensures that it is both effective and relevant to stakeholders.

The following professional framework outlines a solid approach to developing an ESG report:

- Establish a clear purpose and scope. Begin by clearly defining the purpose of the ESG report and identifying the target audience. Determine the key objectives, such as enhancing transparency, meeting regulatory requirements, attracting investors, or addressing stakeholder concerns. Define the scope of the report, including the reporting period, organizational boundaries, and relevant ESG topics to be covered.

- Engage stakeholders. Identify and engage key internal and external stakeholders throughout the reporting process. This may involve conducting stakeholder surveys, interviews, or workshops to understand their expectations, priorities, and concerns regarding ESG issues. Regularly communicate and seek feedback from stakeholders to ensure their perspectives are considered.

- Select appropriate reporting frameworks. Choose a recognized ESG reporting framework or set of guidelines that align with industry standards and stakeholder expectations. Common frameworks include the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-related Financial Disclosures (TCFD), or industry-specific frameworks. Adhere to the chosen framework’s reporting principles, indicators, and disclosure requirements.

- Conduct a materiality assessment. Perform a materiality assessment to identify the ESG issues that are most relevant and impactful for your organization and stakeholders. This involves analyzing the significance of ESG topics based on their potential economic, environmental, and social impacts, as well as their relevance to the company’s operations and stakeholder interests.

- Collect and verify data. Collect accurate, reliable, and relevant data on ESG performance indicators and metrics. Ensure data integrity and consistency by establishing robust data collection systems, processes, and controls. Consider implementing data verification or assurance procedures to enhance credibility, either through internal reviews or external audits conducted by independent third parties.

- Develop a clear structure and narrative. Create a logical and cohesive structure for the ESG report that is easy for stakeholders to navigate. Present the information in a clear, concise, and balanced manner, avoiding jargon and excessive technical language. Develop a narrative that provides context, explains the company’s approach, highlights achievements, and addresses challenges or areas for improvement. Use visual aids, such as charts, graphs, and infographics to enhance data visualization and understanding.

- Set meaningful targets and initiatives. Clearly articulate the company’s ESG goals, targets, and initiatives. Ensure these are measurable, time-bound, and aligned with the company’s overall sustainability strategy. Describe the progress made towards achieving these targets and provide specific examples of actions taken to address ESG challenges. Include information on innovation, research, or collaborations that demonstrate the company’s commitment to continuous improvement.

- Incorporate risk and opportunity assessments. Assess the potential risks and opportunities associated with ESG factors. Discuss how the company identifies, manages, and mitigates ESG-related risks, such as regulatory changes, reputational issues, or supply chain disruptions. Additionally, highlight the business opportunities stemming from addressing ESG challenges, such as cost savings, innovation, market differentiation, or access to capital.

- Seek independent review or assurance. Consider engaging external experts to review or provide assurance on the ESG report’s content, data accuracy, and compliance with reporting frameworks. External verification can enhance credibility and confidence in the report, demonstrating a commitment to transparency and accuracy.

- Perform continuous improvement and iteration. Treat the ESG report as a dynamic and iterative process. Get feedback from stakeholders, evaluate the report’s impact, and identify areas for improvement. Regularly review and update the report to reflect changes in the company’s ESG performance, priorities, and stakeholder expectations.

What are the emerging trends in ESG reporting that businesses should be aware of? According to Adams:

“It seems like ESG reports are playing a bigger role in recruiting as workers look for companies that support the things they believe in. This can lead to happier employees who are more productive and loyal.

As climate change initiatives evolve, the ESG report will be even more important as a tool for companies to show how they impact the environment and what they’re doing to reduce their impact. The data companies include in their reports will certainly change.

Reporting standards will continue to evolve, too, meaning companies will have to stay on top of what they have to say and how.”

How does an ESG report differ from a PR campaign?

ESG reports and PR campaigns each have very distinctive characteristics, and they serve very different purposes.

First, while an ESG report serves to provide comprehensive and transparent information about a company’s environmental, social, and governance practices through factual data and performance metrics, a PR campaign aims to shape public perception about a business, often with a very specific agenda, narrative, and message.

Second, these respective communications are aimed at are very different audiences. While ESG reports are written for specific business stakeholders, such as investors, customers, employees, and regulators, PR campaigns target a broader audience, which includes the wider public and the media.

Another key difference between an ESG report and a PR campaign is the content and focus of each. ESG reports are usually content-rich assessments of a business’s sustainability practices, milestones, and achievements, while a PR campaign strategically tells a story or a “narrative” specifically crafted to create a positive impression.

An ESG report is also traditionally a “warts and all” transparent report, meaning the report should include facts about all the positive and negative ESG business practices. Conversely, a PR campaign may downplay or omit some negative activities in its role to shape positive perceptions.

Finally, ESG reports are long-term stakeholder engagement communications that describe and set out plans for ESG activities over months or even years, while a PR campaign is a short-term promotional tool used to shape positive brand awareness.

When asked about the main challenges in drafting an ESG report, Adams says:

“Our experience is that ESG reports are huge undertakings with many SMEs involved and many moving parts — and often short timeframes. Keeping track of everything can be a challenge. It’s also important to maintain a consistent tone and voice that aligns with the company’s brand.”

Corporate Accountability

It is no secret that some business practices can be downright destructive and unsustainable. For instance, while the use of ‘single use plastics’ has not yet been banned globally, there is a huge shift towards a plastic free society. Leading the way are some the world’s largest music festivals which have gone completely plastic free this year and have even gone as far as banning disposable vapes.

There has also been some good news recently with many maritime nations agreeing to cut global emissions from the shipping industry to net zero by or around 2050. This deal has been criticized by experts who say it falls well short of what’s needed to curb warming to agreed temperature limits.

Globally however, there are still countless large corporations whose activities are harming both people and the planet. From coal and copper mines dumping toxic waste into rivers, to cattle farmers and palm oil producers cutting down swathes of tropical rainforest, these companies are leaving a trail of destruction in their wake – with little concern for either human well-being or the environment.

The question that needs to be asked is: Who should hold these unscrupulous corporations accountable? The answer, unfortunately, is not very straightforward. While we have come long way in writing environmental policies and best practices, when it comes to enforcing these policies, there are several issues:

- Lack of resources. Insufficient funding, staffing, and technological resources can hamper the enforcement of environmental policies. Limited resources may prevent regulatory agencies from conducting adequate inspections, monitoring activities, and taking timely enforcement actions.

- Political interference. Environmental policies and regulations can sometimes face political pressures, resulting in weakened enforcement. Political interference may arise from industry lobbying, conflicting priorities, or regulatory capture, where regulatory agencies become influenced or controlled by the industries they are supposed to regulate.

- Inadequate legal frameworks. Weak or outdated laws, regulations, and penalties can undermine enforcement efforts. In some cases, environmental laws may lack clarity, fail to cover emerging issues, or have lenient penalties that do not deter violations effectively.

- Jurisdictional challenges. Environmental issues often cross jurisdictional boundaries, making enforcement complex. Coordinating enforcement efforts among multiple agencies or levels of government can be challenging, particularly when there are conflicting priorities or differing interpretations of regulations.

- Lack of public awareness and engagement. Public support and awareness are crucial for effective enforcement. When the public is unaware of their rights, the importance of environmental protection, or how to report violations, it can hinder enforcement efforts. Lack of public engagement can also lead to reduced pressure on authorities to enforce policies strictly.

- Corruption and illegal activities. Corruption within regulatory bodies can undermine enforcement by allowing non-compliant activities to go unpunished. Illegal activities, such as wildlife trafficking or illegal waste disposal, may be driven by organized crime networks that can be difficult to investigate and prosecute.

- Technological advances and emerging challenges. Rapid technological advancements and emerging environmental challenges often outpace regulatory frameworks and enforcement capabilities. Issues such as digital pollution and emerging pollutants require continuous adaptation of policies and enforcement mechanisms to effectively address them.

This is why ESG reports are becoming invaluable as they draw a clear line of distinction between organizations that care and those that don’t. Consumers, customers, and investors can hold businesses accountable by choosing to associate only with businesses that take ESG reporting seriously.

One of the main goals of the ESG report is to describe how a business is taking financial responsibility to mitigate their impact on the environment through a variety of initiatives, including conducting environmental impact studies and investing in new sustainable technologies and carbon reduction offset programs, to name a few.

There are various ways in which businesses absorb these costs in the short term. A good example is British Airways commitment to sustainability.

The airline is making huge investments in newer, more fuel-efficient aircraft, funding massive carbon offset projects, and aggressively introducing sustainable aviation fuels made from waste feedstock. In the longer term, British Airways is investing heavily in the development of zero-emission hydrogen powered aircraft and carbon capture technologies.

British Airways is just one example of many great companies that are taking material steps to preserve the environment and build a sustainable future for everyone.

Final Thought

ESG reporting plays a crucial role in today’s business landscape, serving as a means for organizations to disclose their environmental, social, and governance practices to stakeholders.

The reports provide transparency, accountability, and trust, allowing consumers to align their values with companies they support and enabling investors to make informed decisions.

While ESG reporting is not yet mandatory in the United States, companies of all sizes have been encouraged to produce reports to guide their decisions and provide investors with further insights.

The ESG report framework outlined in this article offers a solid approach to developing comprehensive and effective reports. Businesses should be aware of emerging trends in ESG reporting and recognize the importance of corporate accountability in creating a more sustainable and responsible future.

By embracing ESG reporting and taking financial responsibility for their impact on the environment, businesses can demonstrate their commitment to sustainability and build trust among stakeholders.